Global naval defence budgets are more and more constrained, putting pressure on navies around the world to build up their capabilities and fleets to remain powerful on the seven seas. The resurgence of adversaries and their increasing capabilities is forcing allied nations to re-assess their current state and to think about procurement decisions in upcoming years. In a recent survey conducted by Defence IQ, more than 500 respondents from all around the world and to enlighten us on their key priorities in terms of procurement, the biggest threat they are facing and predicted trends for the coming years. The industry represented in the pool of respondents, also gives us exclusive insight into how they perceive the key requirements of the end-users.

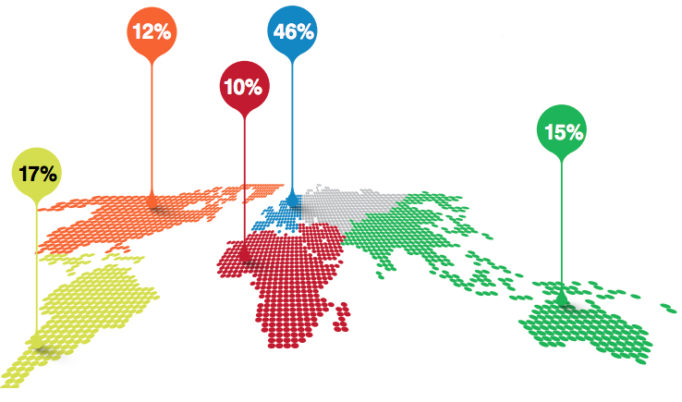

The Respondents. In which region are you based? Respondents from all around the world answered our survey, with the majority from Europe (46%), Latin America (17%), Asia Pacific (15%), North America (12%) and Africa/Middle East (10%).

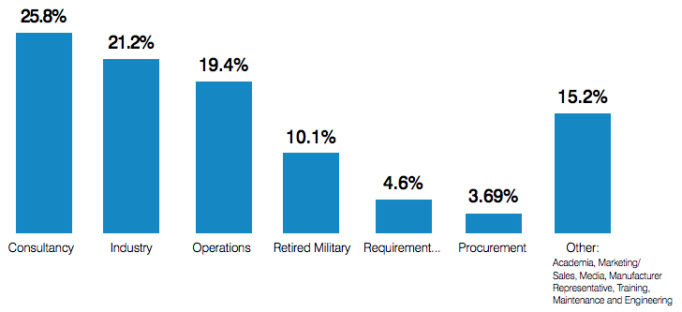

Which of the following describes your role best?

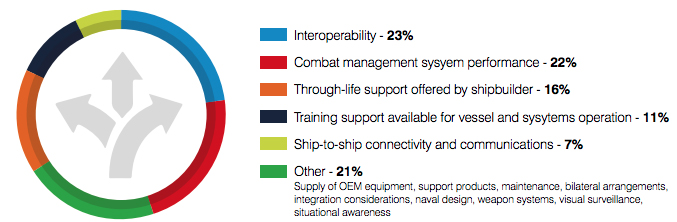

Which of these capabilities is currently a priority and has the greatest impact on your service’s procurement decisions?

Interoperability remains a key theme in procurement decisions, as believed by 23% of all respondents; the capability to operate efficiently in joint operations could shift the dominance on the battlefield from one side to the other and is therefore non-negligible. Combat management systems are close second, accounting for 22%; their performance is essential for crew members to operate successfully and safely in the naval environment. The 21% account for the supply of OEM equipment and support products, maintenance, considerations in integration, naval design, weapon systems, visual surveillance and situational awareness. Through-life support offered by the shipbuilder is fourth in this list (16%), reflecting the need for the navies to reduce costs as much as they can, while maximizing their assets’ life-span and the return on investment on a procurement. Finally, all the best systems in the world are worth nothing if the crew members do not have the necessary skills to operate them; training support available for vessel and system operation comes last, with 11% of respondents choosing it as a priority.

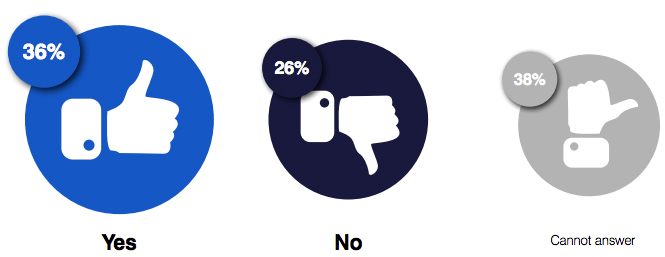

Are you currently experiencing challenges that are hindering your procurement process?

Almost half of the respondents (47.9%) believe that the lack of budget altogether remains the dominant challenge in the procurements process. Surface combatants take considerable time to design and build and are among the most expensive military assets to procure. In Europe, SIPRI recorded an increase of defence spending of 2.6% for Western Europe and 2.4% for Central Europe. However, surface warships are not necessarily a priority, as governments are favoring their submarines fleet instead.

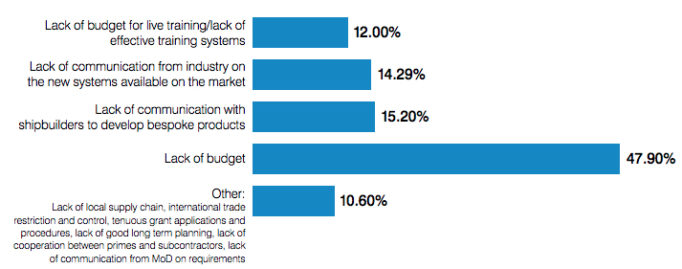

What challenges currently have the biggest impact on the procurement process?

Almost half of the respondents (47.9%) believe that the lack of budget altogether remains the dominant challenge in the procurements process. Surface combatants take considerable time to design and build and are among the most expensive military assets to procure. In Europe, SIPRI recorded an increase of defence spending of 2.6% for Western Europe and 2.4% for Central Europe. However, surface warships are not necessarily a priority, as governments are favoring their submarines fleet instead.

In North America, defence budget has increased, amounting to US$639bn – over 5% of what was authorized the previous year – under President Trump who called for a 350-strong naval fleet during his pre-election campaign. In reality, the 2011 Budget Control Act imposes financial constraints and remains an important limiting factor to the President’s will. The use of OCO funding offers some monetary relief, but the American Defence budget is unlikely to expand as quickly as wanted.

Further North, the Canadian defence policy published in June that spending had to be increased to meet existing defence requirements, but is nonetheless making progress with its long-term plans to reinvigorate its surface warships fleet with the order of 15 Canadian Surface Combatants.

Further South, Latin America’s defence budget fell by circa 8% in 2016 and Brazil – accounting for a third of the area’s military spending – has seen its spending under pressure, due to the economic and political crisis and the wider regional impact of weak commodity prices. A vast bulk of expenditure tends to be allocated to personnel and maintenance, but very little funding is devoted to new acquisitions.

In the Middle East, defence spending remains a high priority, due to the ongoing conflict and tension happening in the region. It also contains three of the world’s top military spending nations: Saudi Arabia, the United Arab Emirates and Israel. However, historic and political factors usually mean that only a small proportion of this spending is allocated to naval procurement. Without counting one or two major exceptions, domestic shipbuilding remains limited, meaning that most major warship acquisitions need to be imported.

The lack of communication also remains a key challenge, with 15.2% of respondents not being able to procure bespoke products due to the lack of information from the industry. They appear to be uninformed on the new systems available on the market (14.3%) as well as the lack of training system information (12%).

The 10.6% forming the “other” section encompass the lack of knowledge of some nations to build new capability, international trade restriction and control, tenuous grant applications and procedures, the lack of a suitable long-term planning, the lack of cooperation between primes and subcontractors and finally the lack of communication from governments on requirements.

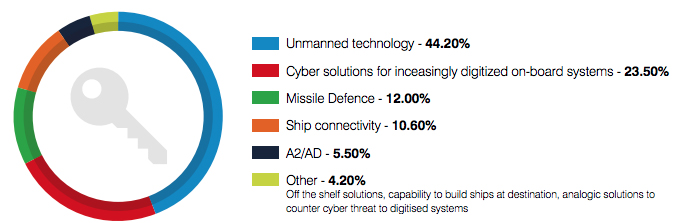

What do you believe will be the key trend in procurement in upcoming years?

Unmanned technology is the key trend in upcoming years, as 44.2% of respondents believe. Systems digitization comes second (23.5%), followed by missile defence (12%), ship connectivity (10.6%) and A2/AD capability (5.5%).

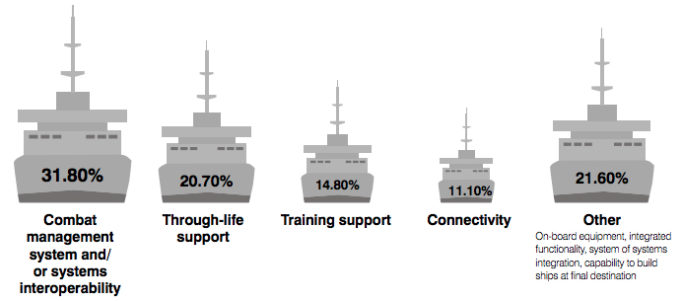

If you are from the industry, what part of your solution (a) differentiates your product most effectively, and (b) features most heavily in your marketing and engagement strategy?

The industry’s focus in terms of marketing best solutions seem to match the military’s procurement priorities, but their communication does not seem to be effective enough, as in total 29.5% of respondents in the previous question viewed the lack of communication with the industry as a key challenge. The industry seems to focus on marketing combat management systems and/or systems interoperability first (31.8%), then 21.6% representing on-board equipment, integrated functionality, systems integration and capability to build ships at the final destination. Through-life support comes third (20.7%), training support (14.8%), and lastly, connectivity (11.1%). The industry seems to have a deficiency in their communication and marketing strategy with the military, a problem that could be partly resolved by the hiring of retired military to join consultancies and help companies grow their business.

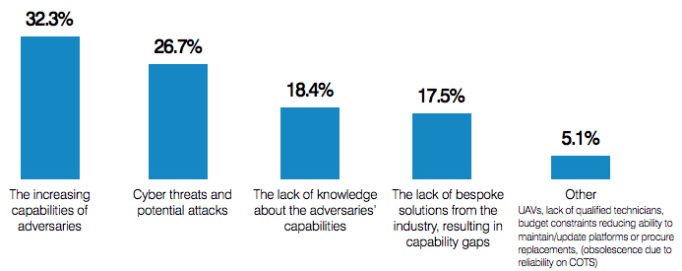

What is the current biggest threat to surface fleets?

Taking Russia’s military resurgence as an example, and the potentiality of the next conflict taking place with conventional warfare, navies from around the world feel increasingly threatened by their adversaries’ capabilities (32.3%). Russia for example has seen a strong growth in its military funding, reaching a peak recently. Three major elements arise from the construction of major surface vessels: Project 22350, Project 11356 and Project 22380. On the other side of the world, North Korea has demonstrated recently its land forces and is estimated to own circa 630 combat vessels. The digitization of systems increases the fear of cyber threats and potential attacks (26.7%) and recent major global cyber attacks can only accentuate this. The lack of knowledge on an opponent’s capabilities is considered as the third-ranked threat (18.4%), closely followed by capability gaps due to the lack of bespoke solutions from the industry (17.5%) and other threats (5.1%), such as UAVs, the lack of proper training and the lack of budget to maintain an operational fleet.

Surface Warships Conference: 29th January – 1st February 2018, London, UK. The 8th annual edition of this successful conference will focus on the modernization of naval forces, interoperability by design and the integration of one another in the global naval community. Key themes include:

- The impact of a resurgent Russian Navy and an increasingly capable Chinese Navy on strategic priorities and platform design/ procurement, and how this will affect your business or organization;

- The quantity vs. quality debate: High-cost, high-capability vessels vs. larger numbers of lower-tech platforms, both as adversaries and as internal procurement options, and what this will mean for the future composition of your navy – or the requirements of your customers;

- In-depth analysis on how the modernization and development of advanced Naval Combat Systems is further increasing the capability of existing and planned platforms and how this could enable you to modernize and upgrade existing platforms more expediently;

- Examination of concerns relating to ship design, in particular the need for area and near-peer denial vs. humanitarian considerations/ disaster relief, and what this means for future platforms. We will examine the increasing need for a modular approach to ship design, in order to guarantee that your high-cost platform is also high capability; and

- Ensuring interoperability between high-end vessels in order to improve coordination and fighting ability, specifically focusing on NATO nations’ modernization and procurement efforts, in order to reduce the cost-burden to individual navies and ensure that allied vessels form a seamlessly integrated fighting force.