Singapore is considered as the top world’s shipping centre for the fifth year in a row, followed by Hong Kong, London, Shanghai, and Dubai. The outcome is based on the International Shipping Centre Development Index (ISCD) issued by Baltic Exchange and Xinhua news agency.

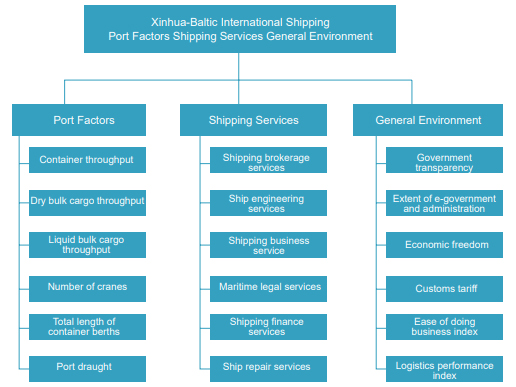

The index, which was first introduced in 2014, ranks 43 of the largest global ports and cities revealing the most important shipping hubs. The index system includes 3 primary indicators and 18 secondary indicators.

The Baltic Exchange and Xinhua published a report in mid-August to analyze the ranking results supporting that Singapore maintains leading position thanks to strategic opportunities brought about by the “Belt and Road” initiative while thanks to Guangdong-Hong Kong-Macau Greater Bay Area, the Hong Kong overtook the second position from London for the first time in five years.

Key Outcomes

- For 2018, the Top Ten International Shipping Centers are Singapore, Hong Kong, London, Shanghai, Dubai, Rotterdam, Hamburg, New York, Tokyo, and Busan, respectively.

- Comparing between 2014-2018, the overall evaluation results are relatively stable.

- Emerging shipping centers in Asia-Pacific region still maintain a strong growth trend.

- Singapore maintains its leading position for four consecutive years, thanks to strategic opportunities brought about by the “Belt and Road” initiative.

- Supported by its rapidly developing modern shipping logistics system and shipping services system, and coordinated development of its regional shipping counterparts, Shanghai advanced to the fourth place, right after London at third place.

- Driven by its innovative free-trade zone and improvement in trade environment, Dubai’s ranking was stable at the fifth place. According to The Executive Magazine, “Dubai has scored a new milestone in its bid to cement its leadership in the international maritime sector after it was selected as one of the world’s top five in the ISCD.

- According to a recent report by the London-based Baltic Exchange and the Xinhua News Agency, Dubai has overtaken Hamburg, confirming anew the emirate’s reputation as one of the leading maritime shipping and logistics centers in the world.

- Busan made its return to the top ten by virtue of its strategy of vigorously developing its transhipment ports.

European and American traditional international shipping centers remain low in ranking. - Rotterdam has improved its operating efficiency with new technology applications such as Internet of Things, big data, and artificial intelligence, as well as smart port construction. It has leaped to the sixth place.

- Impacted by the overall weak economy in the European region, London’s overall shipping development was behind that of Hong Kong, while Hamburg has dropped to seventh place.

The report identifies three tiers, which acknowledge the global shipping centers: the traditionally-renowned tier, the innovation-leader tier, and the potential-for development tier.

- The traditionally-renowned tier of shipping centers is represented by traditionally well-known international centers: Singapore, Hong Kong, and London.

- The innovation-leader tier includes international shipping centers around the Asia-Pacific:Shanghai, Dubai, Guangzhou, and Ningbo-Zhoushan.

- The potential-for-development tier of shipping centers includes developing ports: Newcastle, Tanjung Pelepas, and Port Klang.

Of the top ten shipping centers in the world, 6 are located in Asia, 3 in Europe and only 1 in America. In this regard, the report mentions that there is rapid development in shipping centers in both Asia and Europe, but the rising trend of shipping centers in Asia is becoming increasingly evident.

Global Shipping Services

Although Singapore is considered the top shipping center, in the evaluation of shipping services it holds the second position.

Shipping services are generally evaluated in six aspects: namely ship broking service, ship engineering service, shipping business service, maritime legal service, shipping finance service and ship repair service.

Evaluation of international shipping centers in 2018 shows the top ten port cities with the best shipping services are, by order of ranking: London, Singapore, Hong Kong, Shanghai, Dubai, Athens, Hamburg, New York-New Jersey, Tokyo, and Houston.

Of these, London, Singapore, Hong Kong, and Shanghai have been occupying the top four places for four consecutive years; thus indicating their stability as shipping centers. Houston’s shipping services have gained significant momentum in development and attained the top ten places for the first time in five years.

Global Brokerage Services

Shipping brokerage is the link between many facets of shipping transaction. Therefore, it possesses a huge amount of information related to ship sale transaction and can help in rapid delivery of ships. For a long time, London, as a traditional shipping center, still holds a leading position in shipping brokerage services. In particular, its information resources and the wide network of brokerage companies have exhibited strong competitiveness.

However, with the eastward shifting of the world’s shipping centers, second-tier shipping services in the Asian region, led by Singapore have also taken shape and are beginning to close the gap with London in terms of services.

Trends after Panama Canal Expansion

Connecting the Pacific Ocean and the Atlantic Ocean, the Panama Canal is one of the most important shipping channels in the world. With about 6% of the world’s trade transported through the canal each year, the canal’s usage situation can be regarded as the barometer for global trade.

Thus, this year the report includes an additional chapter analyzing the impact of widening of the Panama Canal, revealing a clear trend of larger-size ships transiting the Canal.

From the size of ships transiting through the Panama Canal, in terms of dimensions and tonnage, there has been a clear trend that ships of growing sizes are passing through the canal after the expansion. In 2015, the average DWT of ship transiting the Panama Canal was 41,538 tons. In 2016, it was 42,900 tons, up 3.28% or 1,362 tons; while in 2017, the increase was even more significant at 49,260 tons, up 14.83% or 6,360 tons.

The report finds that LNG and LPG vessels benefited most from the expansion of the Panama Canal with significant increase in vessel trips and total DWT tonnage, which reflected relatively strong market demand. There was a slight increase in market demand for oil tankers and chemical tankers, but the demand was generally stable. The container ship vessel type is most affected by the trend of growing ship size, with a slight increase in market demand. There was rising recovery of market demand for bulk cargo ships.