E.U.’s offshore wind goals are achievable. The E.U. Commission’s goals for attaining 230GW-450GW of offshore wind by 2050 are achievable provided the right investments in electricity grids, and the European Governments take the right approach to maritime spatial planning. Such is the conclusion of the WindEurope Report, Our Energy, Our Future. The goal of 450GW offshore wind is part of a European Commission scenario to meet 30% of Europe’s electricity demand in 2050, which would have grown 50% compared to 2015 due to electrification. To deliver climate neutrality by 2050, Europe needs a visionary approach to deploy volumes of additional clean energy.

The WindEurope Report indicates where 450GW offshore wind could be deployed most cost-effectively around Europe. At present, there is only 20GW. About 212GW could possibly be deployed in the North Sea; 85GW in the Atlantic Ocean and the Irish Sea; 83GW in the Baltic Sea; and 70GW in the Mediterranean and Southern European waters. This shows the relative wind resources, proximity to energy demand, and location of the supply chain.

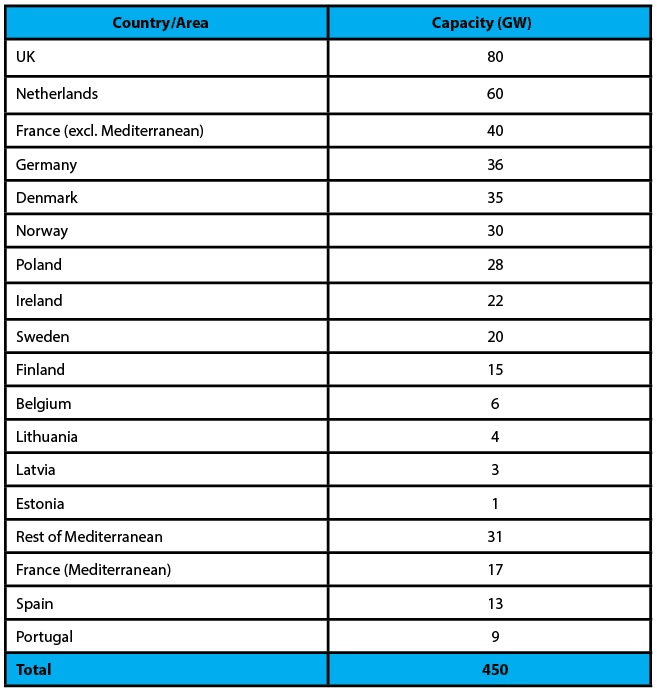

The report breaks down how much offshore wind each country would need to deploy optimally. About 380GW would be deployed by Northern European waters. About 70GW would be covered by Mediterranean countries, Spain and Portugal. Most of the installations would be concentrated in the North Seas.

However, in at least 60% of the North Seas, it is not possible to build offshore wind farms at present. These exclusion zones exist either for environmental reasons or because space had been set aside for fishing, shipping, and military activities. The report states that multiple use, such as allowing certain types of fishing in offshore wind farms would help facilitate offshore wind development and keep expenses down.

Building 450GW offshore wind by 2050 would require Europe to install over 20GW per year by 2030, compared to only 3GW at present. The wind industry is certainly gearing up, but the various European Governments must generate volumes and create revenue schemes for the long-term confidence needed for the necessary investments in the coming years.

The report states, “Offshore wind energy is at the core of how Europe can go carbon-neutral. Europe sits on one of the world’s best offshore wind resources. The 20GW installed covers an average 1.5% of Europe’s annual electricity demand.”

Governments should table a significant growth in offshore wind in their planning for both offshore and onshore grid connections considering the 10-year lead-time for planning and building the grids needed for offshore wind development. Offshore grid investments will need to increase from about €2 billion in 2020 to about €8 billion per year by 2030. Europe would need to provide a regulatory framework for offshore wind farms that have grid connections to more than one country.

Capital expenditure on offshore wind including grids would need to increase from about €6 billion a year in 2020 to about €23 billion by 2030, and thereafter, up to about €45 billion.

WindEurope CEO Giles Dickson said, “The International Energy Agency believes offshore wind could become the no. 1 source of power generation in Europe in the early 2040s. The report shows that it is doable and affordable. But three things need to happen:

(1) the offshore wind supply chain keeps growing;

(2) we build the grid connections; and

(3) we get the maritime spatial planning right.”

The breakdown by country of 450GW goal of offshore wind at present would be as follows ideally:

The full report is available at: https://windeurope.org/wpcontent/uploads/files/about-wind/reports/WindEurope-Our-Energy-Our-Future.pdf